When it comes to old age people forcefully limit themselves to a life of frugality when the maintenance of a reasonably well. Currently the retirement plans available in Malaysia such as employee provident fund EPF and pension scheme is not sufficient in funding the retirees.

6 Must Dos To Include In Your Retirement Plan In Your 20s Infographic Career Resources

In Malaysia even though they are aware of the importance of financial planning most of them lack knowledge on the benefits of it Gan 2008.

. There are many reasons that keep a person from planning for retirement years. One of the key factors when planning for retirement is assessing your cost of living during your golden years. Proper retirement planning is necessary in the event you need to cover any long-term care that you may require later in your life.

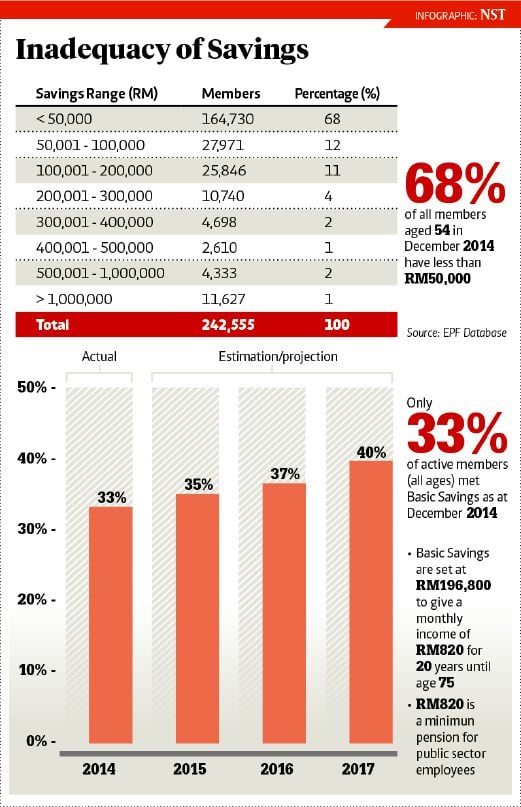

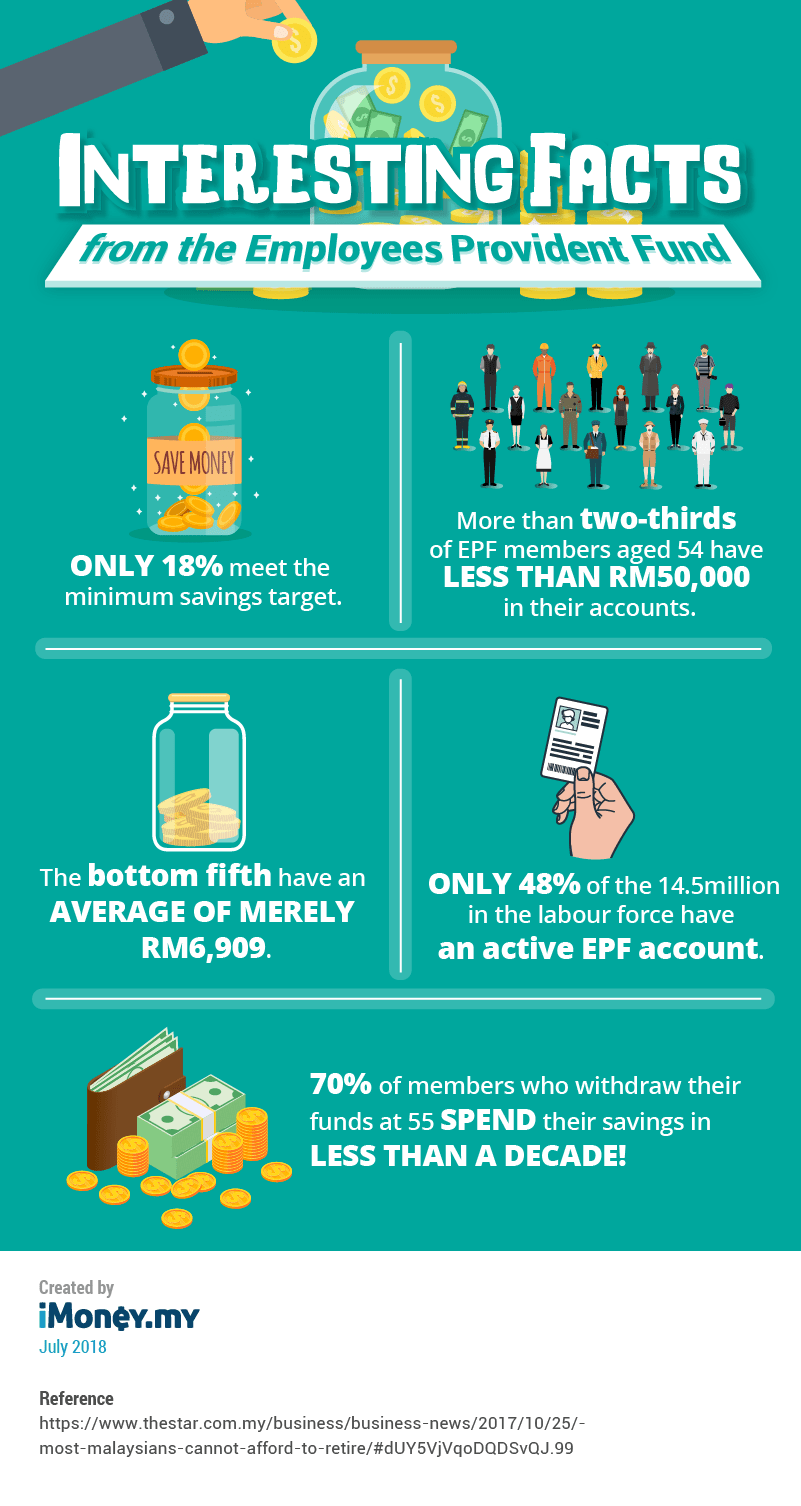

Statistics show that two out of three Employees Provident Fund EPF members aged 54 have less than RM50000 in retirement savings. Importance of Retirement Planning. A structured retirement annuity plan equips you to handle various factors such as surpluses shortfalls and emergencies.

With the income that you receive from your retirement plan. 12 Reasons Why Retirement. Suggestion for Improvement In the nut shell the retirement planning is crucial in order to sustain current lifestyle after retirement.

Find a Dedicated Financial Advisor Now. Your plan can help you calculate the rate of return you need on your investments how much risk you should take and how much income you can safely withdraw from your portfolio. Youll need to account for housing costs utilities travel and expenses associated with your lifestyle.

Retirement is a phase in peoples lives that most go into without much forethought. It is recommended to the government to modify individual financial attitude because attitude can shape individual behavior. Retirees are one of the most vital groups to Malaysias dynamics as the country is witnessing an increase in its ageing population.

You can utilize it for your daily and basic expenses. So ultimately a thorough retirement plan will let you develop a comprehensive understanding of your life goals the aims and define the path the tools to achieve the same. There are plenty of plans based on the needs that you can choose from.

Ad Connect With Expert Financial Advisers and Seek Their Help To You Plan Retirement. Career and recruitment efforts say there are a few questions you can ask that. According to Department of Statistics Malaysia data those aged 65 years or older are expected to make up more than seven per cent of the population this year.

Reasons Why Retirement Planning Is Important. Cost of Living in Malaysia. Ask these 4 questions about a prospective retirement plan.

This puts them at risk of living below the poverty line. 22 Retirement planning behavior Personal retirement planning is not compulsory but a personal option for future preparation. Based on this concept model Financial Retirement Planning behavior can be improved by manipulating both constructs.

Predictors of Financial Retirement Planning among working adult in Malaysia. Retirement planning is important because it can help you avoid running out of money in retirement. Thats why its important to plan for retirement whether youve just started working or have been in the workforce for decades.

Medicare may not cover every form of care so your retirement savings may become your safety net to pay for in-home care or a nursing facility. 10 Nov 2021 4 min Read 2596 Views. The importance of retirement planning is a call in Malaysia due to fast ageing population in the country.

Retirement plans have plenty of benefits and help you stay secure without worrying about the income coming in. When you die you expire but before you die you retire. Retirement Planning Overview.

Ad Know Where You Stand and How to Move Toward Your Goals With Informed Confidence. Engaging in secure retirement planning is crucial to stay financially secure. Ad Do Your Investments Align with Your Goals.

Build Your Future With a Firm that has 85 Years of Retirement Experience. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. As you live you inspire.

In Less Than 24 Hours The Ticket To Final Sprint 2020 Will Be Officially Released This Is A 2 Day Seminar Specifical Financial Advisors How To Become Seminar

Should I Retire To Malaysia Money Saving Mom How To Start A Blog Money Saving Tips

Educating Malaysians On Retirement Savings

Pdf Retirement Planning In Malaysia Issues And Challenges To Achieve Sustainable Lifestyle Semantic Scholar

Pdf Retirement Planning In Malaysia Issues And Challenges To Achieve Sustainable Lifestyle Semantic Scholar

Pdf Retirement Planning In Malaysia Issues And Challenges To Achieve Sustainable Lifestyle Semantic Scholar

How Much Do Malaysians Really Need For Retirement

Retirement In Malaysia Part 9 Culture People Retirepedia Malaysia Culture People

Pdf Parents Influence On Retirement Planning In Malaysia

Pdf Retirement Planning In Malaysia Issues And Challenges To Achieve Sustainable Lifestyle Semantic Scholar

Climate Weather In Malaysia Retire In Malaysia Part 1 Retirepedia Malaysia Resorts Malaysia Retire Abroad

Pdf Retirement Awareness Among The Working Population Below 40 In Malaysia

Pdf Retirement Planning In Malaysia Issues And Challenges To Achieve Sustainable Lifestyle

By Maintaining A Positive Attitude And Zest For Life Exploring Your Dreams Updating Your Looks Increasing Y Positive Attitude Finding Yourself Stay In Shape

Pdf Retirement Planning In Malaysia Issues And Challenges To Achieve Sustainable Lifestyle Semantic Scholar

Pdf Retirement Planning In Malaysia Issues And Challenges To Achieve Sustainable Lifestyle Semantic Scholar

How Much Do Malaysians Really Need For Retirement

Willstrustsestates Prof Blogattorney Stole Mentally